Finance Dashboard

The Finance Dashboard gives you a real-time view of your company's financial health. It's designed to help you monitor cash flow, track expenses, and identify trends at a glance.

Accessing the Finance Dashboard

Navigate to Dashboard in the left sidebar, then select the Finance tab at the top of the page. This is the default view when you open your dashboard.

Dashboard Widgets

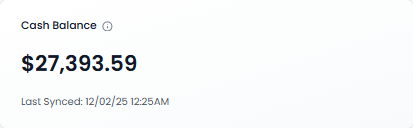

Cash Balance

Your current cash position across all connected bank accounts.

What it shows: Sum of all checking, savings, and treasury account balances. Includes cash-equivalent investment accounts. Updates automatically when accounts are synced.

Last Synced: Displays the most recent sync time with your connected accounts

Why it matters: This is your operating capital—the money available to run your business day-to-day

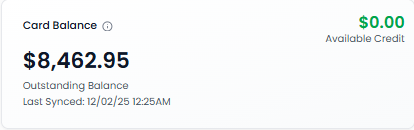

Card Balance

Summary of your business credit card position.

Outstanding Balance: Total amount currently owed across all connected credit cards. Available Credit: remaining credit limit across all cards.

Available Credit: Remaining credit limit across all cards

Last Synced: Most recent update from your credit card accounts

Why it matters: Helps you manage credit utilization and avoid hitting credit limits

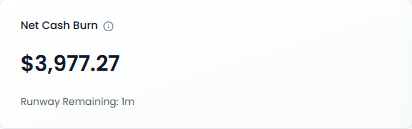

Net Cash Burn

The average monthly difference between your cash outflows and inflows.

Calculation: Average Monthly (Cash Out - Cash In). Calculated as the average difference between your monthly cash outflows and inflows. A positive number indicates you're spending more than earning (burning cash). A negative number means you have positive cash flow.

Positive number: You're burning cash (spending more than earning)

Negative number: You have positive cash flow (earning more than spending)

Runway Remaining: How long your current cash balance will last at the current burn rate

Shows "∞ Unlimited" when you have positive cash flow

Why it matters: Critical for understanding how long you can operate before needing additional funding

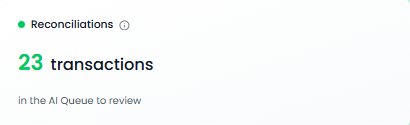

Reconciliations

Quick view of transactions waiting to be categorized.

What it shows: Number of transactions waiting to be categorized. AI automatically categorizes these transactions, which you can review and approve in the Reconciliations page.

Status: Good (Green <25) • Yellow (25-75) • Red (>75)

Action: Click the widget to go directly to the Reconciliations page

Why it matters: Uncategorized transactions affect the accuracy of your financial reports. The AI automatically categorizes most transactions, but some require human review

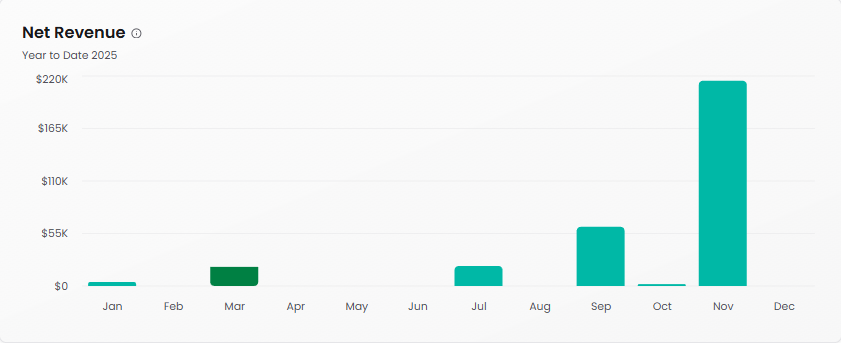

Net Revenue

Year-to-date revenue tracking showing monthly trends.

What it shows: Shows operating revenue from core business activities (subscriptions, services, sales). Excludes non-operating income (interest, FX gains) and contra revenue (discounts, returns). Only displays categories with actual transactions. Accounts for deferred revenue schedules. Uses accrual accounting (revenue recognized when invoiced). Calendar year-to-date.

Time period: Current year to date

Why it matters: Track revenue growth patterns and identify seasonal trends in your business

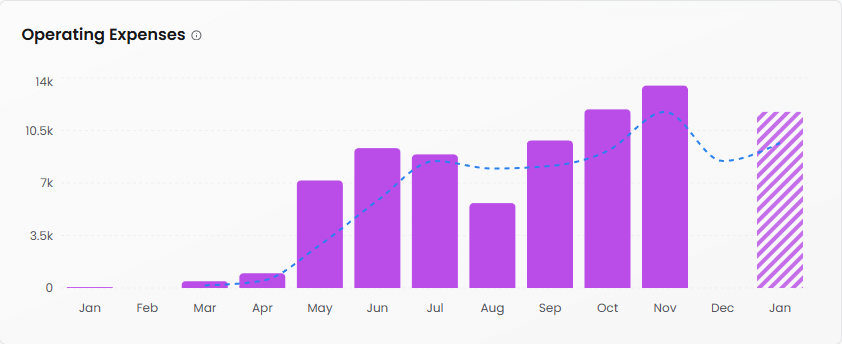

Operating Expenses

Monthly operating expense tracking with trend analysis.

What it shows: Your monthly operating expenses with a trend line. Shows your total business expenses for each month. The striped bar indicates projected expenses for the upcoming month. The dashed line shows the 3-month moving average trend.

Projection: The patterned bar (typically the current or future month) shows projected expenses based on historical trends

Dotted line: Trend indicator showing whether expenses are increasing or decreasing

Why it matters: Spot unusual spending patterns and keep expenses under control

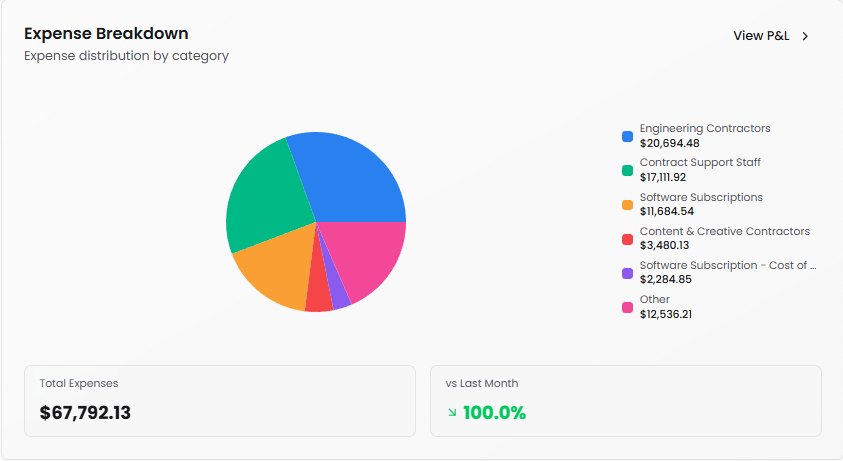

Expense Breakdown

Visual breakdown of where your money goes.

What it shows: Expense distribution by category (pie chart)

View P&L: Click to see your detailed Profit & Loss statement

Why it matters: Quickly identify your largest expense categories and spot opportunities to optimize spending

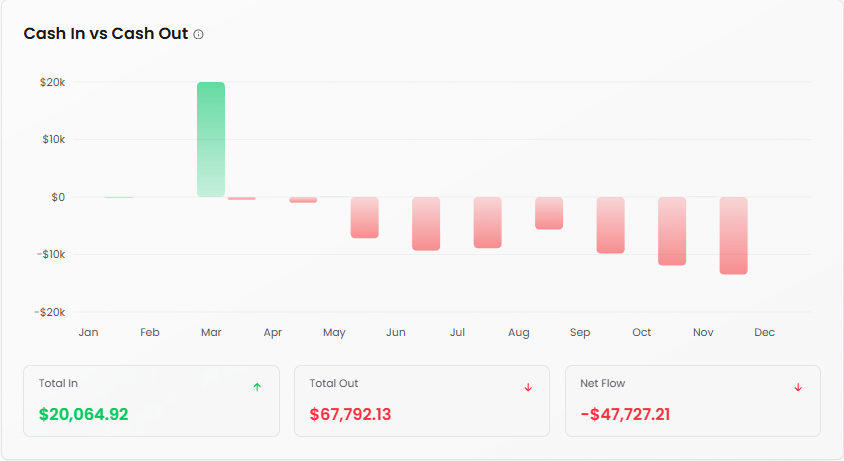

Cash In vs Cash Out

Compare monthly cash inflows and outflows side by side.

What it shows: Visualizes your cash inflows (green bars) versus outflows (red bars) for each month. Positive net flow means more money coming in than going out.

Green bars: Cash coming in

Red bars: Cash going out

Toggle: Enable "Show Net Cash Flow" to overlay the net difference

Why it matters: Visualize cash flow patterns and identify months with cash crunches

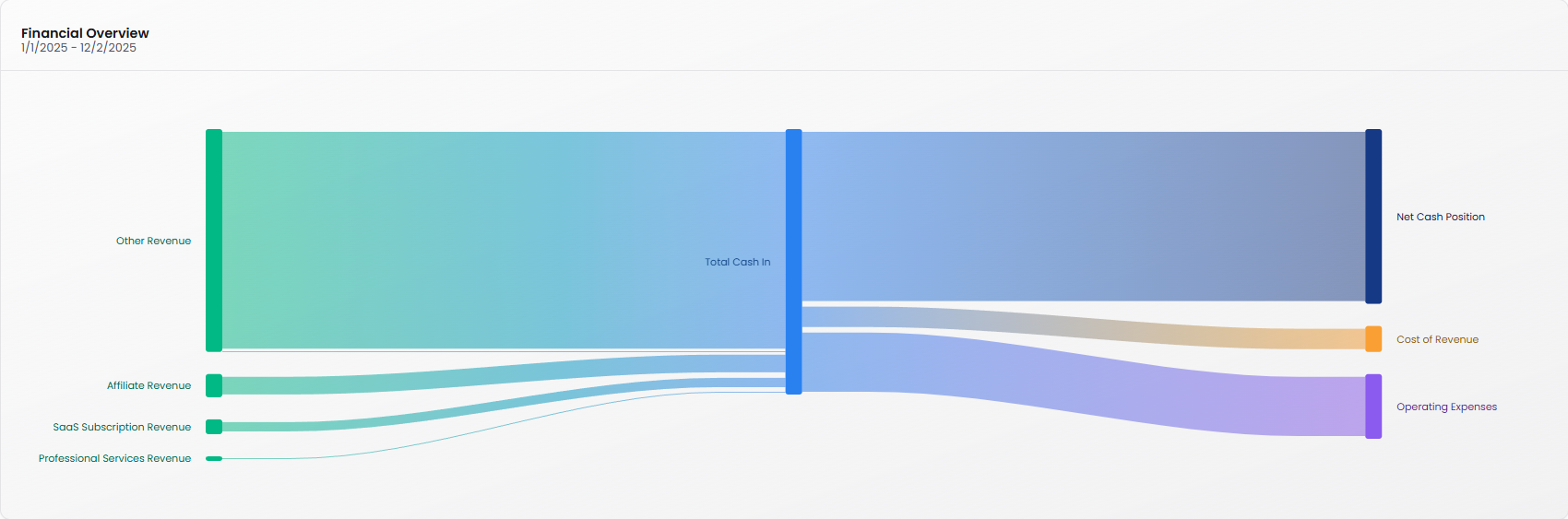

Financial Overview

High-level comparison of revenue sources and expense categories.

Time period: Displays date range (e.g., 1/1/2025 - 11/24/2025)

Categories shown:

Total Cash In (blue)

Cost of Revenue (orange)

Operating Expenses (purple)

Onboarding Fees (teal)

Partnership Revenue (green)

Why it matters: Compare the relative size of revenue streams and major expense categories at a glance

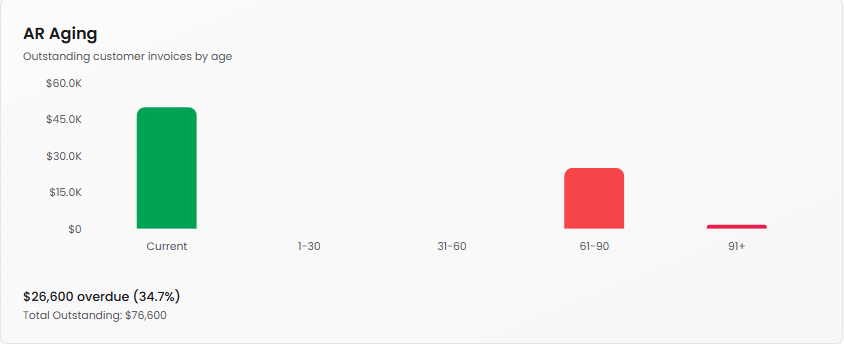

AR Aging

Outstanding customer invoices by age.

What it shows: Outstanding customer invoices by age

Age categories: Current (green), 1-30, 31-60, 61-90 (red), 91+ (red)

Summary: Shows total overdue amount and percentage of total outstanding (e.g., "$26,600 overdue (34.7%)" with "Total Outstanding $76,600")

Why it matters: Monitor which customers owe you money and how long invoices have been outstanding. This helps you manage cash flow and identify collection issues

AP Aging

Outstanding vendor bills by age.

What it shows: Outstanding vendor bills by age

Age categories: Current, 1-30, 31-60, 61-90, 91+

Status: Displays "No outstanding bills" when all bills are paid

Why it matters: Track what you owe to vendors and when payments are due. Helps maintain good vendor relationships and plan for cash outflows

Tips for Using the Finance Dashboard

Review frequency: Check daily or weekly to stay on top of your financial position. The dashboard syncs automatically with your connected accounts.

Watch your burn: If your Net Cash Burn is positive and your runway is decreasing, consider either reducing expenses or accelerating revenue growth.

Reconcile regularly: Don't let the transaction queue build up. Regular reconciliation keeps your financial data accurate and audit-ready.

Spot trends early: Use the trend lines in Operating Expenses and the monthly patterns in Cash In vs Cash Out to anticipate problems before they become critical.